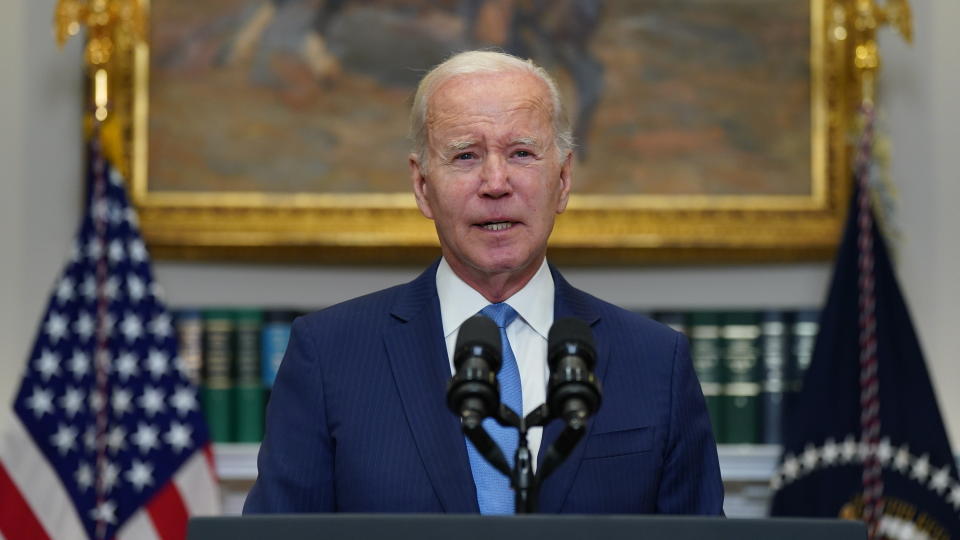

President Biden Proposes Sweeping Changes to Social Security

As the Social Security trust fund faces depletion by 2033, President Joe Biden has proposed a four-point plan to bolster the program’s finances. The plan, which has been met with mixed reactions, would raise taxes on high-income earners, increase cost-of-living adjustments (COLAs), and expand benefits for low-income workers.

Implementing a Payroll Tax for Income Over $400,000

Currently, the payroll tax is only paid on income up to $160,200. This means that high-income earners who make more than $160,200 per year do not have to pay any additional taxes on their earnings. President Biden has proposed a plan to change this by expanding the payroll tax to income over $400,000. This would mean that high-income earners would have to pay a payroll tax on all of their earnings, just like everyone else.

The purpose of expanding the payroll tax is to generate additional revenue for Social Security. Social Security is a vital program that provides retirement, disability, and survivor benefits to millions of Americans. However, the program is facing a long-term funding shortfall. Expanding the payroll tax would help to close this shortfall and ensure that Social Security remains solvent for future generations.

There are a few arguments in favor of expanding the payroll tax. First, it is a fair way to raise revenue. High-income earners can afford to pay more in taxes, and they are more likely to benefit from Social Security benefits in the future. Second, expanding the payroll tax would help to reduce income inequality. By taxing high-income earners at a higher rate, we can help to create a more equitable society.

Of course, there are also some arguments against expanding the payroll tax. Some people argue that it would discourage work and investment. Others argue that it would be unfair to high-income earners who already pay a lot in taxes.

Ultimately, the decision of whether or not to expand the payroll tax is a political one. However, it is a decision that we need to make soon. Social Security is a vital program, and we need to take steps to ensure its long-term solvency.

Changing the Way COLA Increases Are Calculated

Each year, Social Security benefits are increased to help keep up with inflation. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) is currently used to calculate COLAs. However, this number doesn’t necessarily reflect the lifestyle and expenses of retired people. For example, the CPI-W does not include the cost of healthcare, which is a major expense for many retirees.

President Biden has proposed a plan to change the way COLAs are calculated. He would use the Consumer Price Index for the Elderly (CPI-E) to calculate COLAs. The CPI-E is a more accurate measure of inflation for retired people, as it includes the cost of healthcare.

Changing the way COLAs are calculated would result in higher COLAs for retirees. This would help to ensure that retirees’ benefits keep up with the rising cost of living.

Of course, there are some arguments against changing the way COLAs are calculated. Some people argue that it would be too expensive. Others argue that it would be unfair to younger workers, who would have to pay higher taxes to fund the higher COLAs.

Increasing the Primary Insurance Amount (PIA)

The Primary Insurance Amount (PIA) is the amount of Social Security benefits you are entitled to if you retire at full retirement age. Currently, the PIA is based on your average indexed monthly earnings (AIME), which is a measure of your lifetime earnings. However, the PIA does not take into account the rising cost of living, which can make it difficult for retirees to make ends meet.

President Biden has proposed a plan to increase the PIA for Americans aged 78 to 82. This would help to offset the rising cost of living and ensure that retirees have a more secure financial future.

Increasing the Special Minimum Benefit for Lifetime Lower-Wage Workers

The Special Minimum Benefit is a minimum benefit that is paid to certain workers who have paid Social Security taxes for a long time but have low lifetime earnings. Currently, the Special Minimum Benefit is set at $12,402 per year, or $1,033.50 per month. This is not enough to live on for many people, especially those who have high medical expenses.

President Biden has proposed a plan to increase the Special Minimum Benefit to 125% of the federal poverty level for an individual. This would mean that a single person with low lifetime earnings would receive $1,518.75 per month in Social Security benefits.

These changes would help to ensure that all retirees have a more secure financial future. They would also help to reduce income inequality, as they would disproportionately benefit low-income retirees.

Of course, there are some arguments against these changes. Some people argue that they would be too expensive. Others argue that they would discourage work, as people would be less likely to work if they knew they would receive a higher benefit from Social Security.

The Future of Social Security

It is unclear whether Biden’s plan will be enacted. However, the issue of Social Security reform is likely to continue to be debated in the years to come. The program is facing a number of challenges, including an aging population and rising healthcare costs. These challenges will need to be addressed in order to ensure the long-term sustainability of Social Security.

What You Can Do

If you are concerned about the future of Social Security, there are a few things you can do to protect yourself. First, you can make sure you are maximizing your Social Security benefits by working as long as possible and earning as much as possible. Second, you can save for retirement on your own through a 401(k), IRA, or other retirement savings account. Finally, you can stay informed about the latest changes to Social Security and how they could impact your retirement.

FAQs

What is the highest amount you can get from Social Security?

There are three steps to obtaining the maximum monthly Social Security income of $4,555.

What is the full retirement age for Social Security?

If you were born between 1943 and 1954, your full retirement age is 66. If you were born between 1955 and 1960, your full retirement age will steadily rise until it reaches 67. Full retirement benefits are payable at the age of 67 to everyone born in 1960 or later.

What is the latest Cola estimate for 2023?

While the 2022 COLA adjustment was 5.9%, government inflation data revealed that costs increased at a greater rate for much of last year. Now, the 8.7% COLA for 2023 is exceeding current inflation, with a 5.8% increase in the consumer price index for urban wage earners and clerical workers, or CPI-W, over the previous 12 months.

How much Social Security will I get if I was born in 1960?

Your complete retirement age if you were born in 1960 is 67.

The average Social Security retirement benefit for a retired worker in February 2023 was $1,830 per month.

Additional Resources