Starting a financial blog can be a great way to share your knowledge and expertise with others, and it can also be a profitable venture.

If you’re interested in starting a financial blog, here are some steps you can follow:

1. Choose a niche.

The first step is to choose a niche for your blog. This will help you focus your content and attract a specific audience. There are many different financial niches you could choose from.

Here are some factors to consider when choosing a niche for your financial blog:

- Your interests and expertise: What are you passionate about when it comes to personal finance? What do you know a lot about? Choosing a niche that you’re interested in and knowledgeable about will make it more enjoyable to write about and will help you create high-quality content.

- The size of the audience: How many people are interested in the niche you’re considering? If you choose a niche that’s too small, you may have a hard time attracting an audience. On the other hand, if you choose a niche that’s too large, you’ll face a lot of competition.

- The monetization opportunities: What are the monetization opportunities available in the niche you’re considering? Some niches are more conducive to monetization than others. For example, if you’re interested in investing, you could promote financial products or services on your blog.

Once you've considered these factors, you can start brainstorming ideas for niches. Here are a few ideas to get you started:

- Budgeting and saving: This is a popular niche, as many people are interested in learning how to better manage their money.

- Investing: This is another popular niche, as more and more people are interested in investing their money for the future.

- Personal finance: This is a broad niche that covers a wide range of topics, such as debt management, credit scores, and retirement planning.

- Frugal living: This niche is for people who are interested in living a simpler, more affordable lifestyle.

- Millennial Money: This niche is for people who are in their 20s and 30s and are trying to figure out how to manage their money.

- Women’s money: This niche is for women who are interested in learning about personal finance and investing.

- Retirement planning: This niche is for people who are interested in planning for their retirement.

Once you’ve chosen a niche, you can start brainstorming ideas for blog posts. You should also research other blogs in your niche to see what topics they’re covering and how they’re writing their content.

2. Set up your blog.

Once you’ve chosen a niche and have some ideas for blog posts, you need to set up your blog. There are many different platforms you can use to create a blog, such as WordPress, Blogger, and Tumblr.

If you’re not sure which platform to choose, WordPress is a good option for beginners. It’s easy to use and there are many plugins and themes available to help you customize your blog.

Setting up a blog is a relatively straightforward process, but there are a few things you need to do to get started.

1. Choose a platform.

As mentioned above, there are many different platforms you can use to create a blog. Some of the most popular platforms include:

- WordPress: WordPress is the most popular blogging platform in the world. It’s easy to use and there are many plugins and themes available to help you customize your blog.

- Blogger: Blogger is a free blogging platform offered by Google. It’s easy to use and you can start a blog quickly and easily.

- Tumblr: Tumblr is a microblogging platform that’s popular for sharing short, informal posts. It’s a good option if you want to create a blog that’s more personal and less formal.

2. Choose a domain name and hosting provider.

Once you’ve chosen a platform, you need to choose a domain name and hosting provider. A domain name is your blog’s address on the internet, such as www.example.com. A hosting provider is a company that stores your blog’s files and makes them accessible to visitors.

There are many different domain name registrars and hosting providers available. Some of the most popular include:

- GoDaddy: GoDaddy is a popular domain name registrar and hosting provider. They offer a wide range of features and services, including domain registration, web hosting, and email hosting.

- Namecheap: Namecheap is another popular domain name registrar and hosting provider. They offer affordable prices and a wide range of features.

- Bluehost: Bluehost is a popular hosting provider that’s known for its reliability and customer support. They offer a variety of hosting plans to fit different budgets and needs.

- Hostinger: Hostinger is a popular hosting provider that’s known for its customer support and good hosting plan at a cheap price. They offer a variety of hosting plans to fit different budgets and needs.

We suggest you, go with the Hostinger plan which starts at only $1.99 per month.

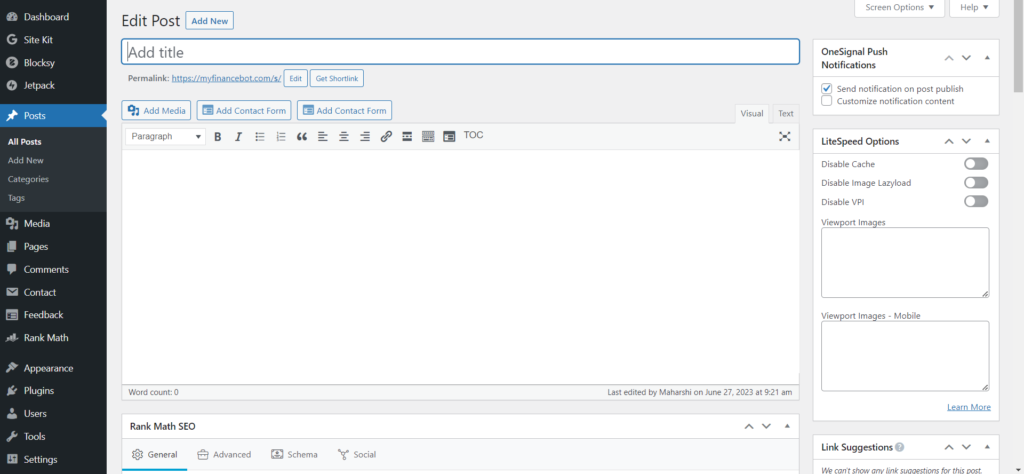

3. Install WordPress.

Once you’ve chosen a domain name and hosting provider, you need to install WordPress. WordPress is a free and open-source content management system (CMS) that makes it easy to create and manage a blog.

You can install WordPress on your hosting account or use a WordPress hosting provider like Hostinger, Bluehost, or SiteGround.

4. Choose a theme and customize your blog.

Once you’ve installed WordPress, you need to choose a theme and customize your blog. A theme is a pre-made design that controls the look and feel of your blog. There are many different themes available, so you can find one that matches your style and branding.

You can also customize your blog by adding widgets, plugins, and other features. Widgets are small pieces of code that can be added to your blog to display things like social media buttons, contact information, and recent posts. Plugins are add-ons that can extend the functionality of WordPress.

5. Start writing blog posts.

Once you’ve set up your blog, it’s time to start writing blog posts. Blog posts are the content that will attract visitors to your blog and keep them coming back.

When you’re writing blog posts, be sure to:

- Write about topics that your audience is interested in.

- Use clear and concise language.

- Proofread your posts before publishing them.

- Promote your posts on social media and other channels.

By following these tips, you can create a successful financial blog that will help you achieve your financial goals.

3. Create high-quality content.

The most important thing you can do to succeed with your financial blog is to create high-quality content. This means writing informative and engaging posts that will help your readers achieve their financial goals.

When you’re writing your blog posts, be sure to do your research and provide accurate information. You should also use clear and concise language that your readers can understand.

Here are some tips for creating high-quality content for your financial blog:

- Do your research. Before you write a blog post, make sure you do your research and have a good understanding of the topic you’re writing about. This will help you ensure that your information is accurate and up-to-date.

- Use clear and concise language. When you’re writing about financial topics, it’s important to use clear and concise language that your readers can understand. Avoid using jargon or technical terms that your readers may not be familiar with.

- Be informative and engaging. Your blog posts should be informative and engaging. This means providing your readers with valuable information that they can use to improve their financial situation. It also means making your blog posts interesting and easy to read.

- Proofread your work. Before you publish your blog post, be sure to proofread it carefully for any errors in grammar or spelling. This will help you ensure that your post is professional and polished.

4. Promote your blog.

Promoting your blog is essential if you want people to find it and read your content. There are many different ways to promote your blog, but some of the most effective methods include:

- Social media: Share your blog posts on social media platforms like Facebook, Twitter, and LinkedIn. This is a great way to reach a large audience and get people talking about your blog.

- Email Marketing: Build an email list and send out regular newsletters to your subscribers. This is a great way to stay in touch with your readers and keep them coming back for more.

- Guest blogging: Write guest posts on other blogs in your niche. This is a great way to get your blog in front of a new audience and build backlinks to your site.

- Search engine optimization (SEO): Optimize your blog posts for search engines so they can be found more easily. This means using relevant keywords and phrases in your titles, headers, and throughout your content.

By following these tips, you can promote your blog and attract more readers.

5. Monetize your blog.

Once you’ve built up a following, you can start monetizing your blog. There are many different ways to monetize a financial blog. Some of the most popular methods include:

- Display ads: You can sell ad space on your blog to advertisers. This is a relatively passive way to make money, but the amount you earn will depend on the number of visitors your blog gets and the type of ads you run.

- Affiliate marketing: You can promote products or services from other companies and earn a commission on sales. This is a more active way to make money, but it can be more lucrative if you promote products or services that your audience is interested in.

- Selling your products or services: You can sell your products or services on your blog. This is a great way to make money if you have a product or service that you’re passionate about and that you believe your audience will benefit from.

Types of Financial Blogs

There are many different types of financial blogs, each with its focus. Some of the most popular types of financial blogs include:

- Personal finance blogs: These blogs focus on helping people manage their finances. They typically cover topics such as budgeting, saving, debt management, and investing.

- Investing blogs: These blogs focus on helping people learn about investing and how to build wealth through investing. They typically cover topics such as stocks, bonds, mutual funds, and ETFs.

- Budgeting blogs: These blogs focus on helping people create and stick to a budget. They typically cover topics such as tracking expenses, setting financial goals, and saving money.

- Retirement planning blogs: These blogs focus on helping people plan for retirement. They typically cover topics such as saving for retirement, choosing the right retirement accounts, and generating income in retirement.

- Millennial money blogs: These blogs focus on helping millennials manage their finances. They typically cover topics such as student loans, saving for a down payment, and investing for the future.

- Women’s money blogs: These blogs focus on helping women manage their finances. They typically cover topics such as budgeting, saving for a rainy day, and investing for the future.

Monetizing a Financial Blog

There are many different ways to monetize a financial blog. Some of the most popular methods include:

- Display ads: You can sell ad space on your blog to advertisers. This is a relatively passive way to make money, but the amount you earn will depend on the number of visitors your blog gets and the type of ads you run.

- Affiliate marketing: You can promote products or services from other companies and earn a commission on sales. This is a more active way to make money, but it can be more lucrative if you promote products or services that your audience is interested in.

- Selling your products or services: You can sell your products or services on your blog. This is a great way to make money if you have a product or service that you’re passionate about and that you believe your audience will benefit from.

- Selling subscriptions: You can sell subscriptions to your blog or t premium content on your blog. This is a good way to make money if you have a loyal following of readers who are willing to pay for exclusive content.

- Selling courses: You can create and sell courses on financial topics. This is a great way to share your knowledge and expertise with others and to make money at the same time.

You can start with our different RSS feed.

- Personal Finance: Click Here

- Financial Planning: Click Here

- Investment: Click Here

- Stocks: Click Here

- Earning Money: Click Here

- Cryptocurrency: Click Here

- How To: Click Here

Choosing a Monetization Method

The best way to monetize your financial blog will depend on your own goals and interests. If you’re looking for a passive way to make money, then display ads may be a good option for you. If you’re looking for a more active way to make money, then affiliate marketing or selling your own products or services may be a better option.

No matter what monetization method you choose, be sure to create content that is relevant to your audience and that they will find valuable. If you can do that, you’ll be well on your way to making money from your financial blog.

Choosing a Type of Financial Blog

The type of financial blog you choose will depend on your interests and expertise. If you’re passionate about personal finance, then you might want to start a personal finance blog. If you’re interested in investing, then you might want to start an investing blog. And if you’re passionate about helping millennials manage their finances, then you might want to start a millennial money blog.

No matter what type of financial blog you choose, be sure to create content that is informative and engaging. Your goal is to help your readers achieve their financial goals, so make sure your content is relevant to their needs.

Challenges of Starting a Financial Blog

Starting a financial blog can be a great way to share your knowledge and expertise with others, and it can also be a profitable venture. However, there are also some challenges that you may face along the way.

Some of the challenges of starting a financial blog include:

- Finding a niche: One of the first challenges you’ll face is finding a niche for your blog. This means finding a specific topic or area of finance that you’re passionate about and that you have expertise. Once you’ve found a niche, you can start to create content that is relevant to your target audience.

- Creating high-quality content: Another challenge you’ll face is creating high-quality content. This means writing blog posts that are informative, engaging and well-researched. You’ll also need to make sure that your content is optimized for search engines so that people can find it easily.

- Promoting your blog: Once you’ve created some high-quality content, you’ll need to promote your blog so that people can find it. This can be done through social media, email marketing, and guest blogging.

- Making money: If you want to make money from your financial blog, you’ll need to find a way to monetize it. There are several different ways to monetize a financial blog, but some of the most popular methods include display ads, affiliate marketing, and selling your products or services.

Overcoming the Challenges

The challenges of starting a financial blog can be daunting, but they’re not insurmountable. If you’re willing to put in the hard work and dedication, you can overcome these challenges and build a successful financial blog.

Here are some tips for overcoming the challenges of starting a financial blog:

- Be patient: It takes time to build a successful blog. Don’t expect to start making money overnight. Just keep creating high-quality content and promoting your blog, and eventually, you’ll start to see results.

- Be persistent: There will be times when you want to give up. But if you’re persistent, you’ll eventually overcome the challenges and achieve your goals.

- Be creative: There are many different ways to monetize a financial blog. Don’t be afraid to get creative and try new things. The more creative you are, the more likely you are to find a monetization method that works for you.

Conclusion

Starting a financial blog can be a great way to share your knowledge and expertise with others, and it can also be a profitable venture. If you’re interested in starting a financial blog, be sure to follow the steps outlined in this article. With hard work and dedication, you can build a successful financial blog that will help you achieve your financial goals.

Additional Resources

- How to Start a Finance Blog in 5 Steps By DomainWheel: https://domainwheel.com/how-to-start-a-finance-blog/#gref

- How to Start a Finance Blog | TRUiC: https://howtostartanllc.com/how-to-start-a-blog/how-to-start-a-finance-blog

- Do financial blogs make money?: https://www.retirebeforedad.com/how-blogs-make-money/#:~:text=Most%20clicks%20earn%20little%20to,ads%20are%20the%20most%20common.

- What should be included in a finance blog?: https://www.contentcucumber.com/blog/10-great-blog-topic-ideas-for-finance-companies

FAQs

- Select a strategic niche.

- Create a memorable domain name.

- Register for web hosting.

- WordPress should be installed.

- Download a few necessary plugins.

- Choose a theme and customize your website.

- Create legal pages for your blog.

- Prepare and write your initial posts.

The majority of clicks yield little to nothing. However, only a small fraction of clicks will result in a conversion or profit. Display ads, affiliate sales, and product sales are the three main ways personal finance writers generate money directly from their blogs. The most prevalent type of advertisement is a display ad.

There are many different niches you could choose for your financial blog. Some popular options include:

- Personal finance: This is a broad niche that encompasses topics such as budgeting, saving, investing, and debt management.

- Investing: This niche focuses on helping people make informed investment decisions.

- Retirement planning: This niche helps people plan for their retirement years.

- Frugal living: This niche focuses on helping people live comfortable life on a budget.

- Personal finance for women: This niche provides financial advice specifically for women.

The best way to choose a niche for your financial blog is to choose something you’re passionate about and that you have some expertise in. You should also choose a niche that you think there is a demand for.

There are a few different ways to set up a financial blog. You can use a self-hosted platform like WordPress or Blogger, or you can use a hosted platform like Tumblr or Medium.

If you choose to use a self-hosted platform, you’ll need to purchase a domain name and web hosting. You can then install WordPress or another blogging platform on your web hosting account.

If you choose to use a hosted platform, you won’t need to purchase a domain name or web hosting. However, you’ll be limited to the features and functionality that the platform offers.

When writing blog posts for your financial blog, it’s important to keep your target audience in mind. You should also make sure your posts are well-researched and informative.

Here are some tips:

- Start with a strong headline.

- Write about topics that your audience will care about.

- Provide value in your posts.

- Use clear and concise language.

- Proofread your posts carefully before publishing them.

Once you’ve started writing blog posts, you need to promote your blog to get people to read them.

Here are some tips for promoting your financial blog:

- Share your posts on social media.

- Submit your posts to directories and search engines.

- Guest blog on other websites.

- Run advertising campaigns.