What Is Manappuram Finance?

Manappuram Finance Ltd. is a non-banking financial company (NBFC) that offers a variety of financial products and services, including gold loans, personal loans, business loans, and insurance. The company was founded in 1949 and is headquartered in Kerala, India. Manappuram Finance has a wide network of branches across India, and it also offers its products and services online.

History of Manappuram Finance

Manappuram Finance was founded in 1949 by M.P. Appachi Ramachandran. The company started as a small gold loan business, but it quickly grew to become one of the leading NBFCs in India. Manappuram Finance went public in 2000, and it has since expanded its product offerings and its geographic reach.

Vision and mission of Manappuram Finance

The vision of Manappuram Finance is to be “the most trusted financial services provider in India.” The mission of the company is to “provide financial solutions that meet the needs of our customers and help them achieve their financial goals.”

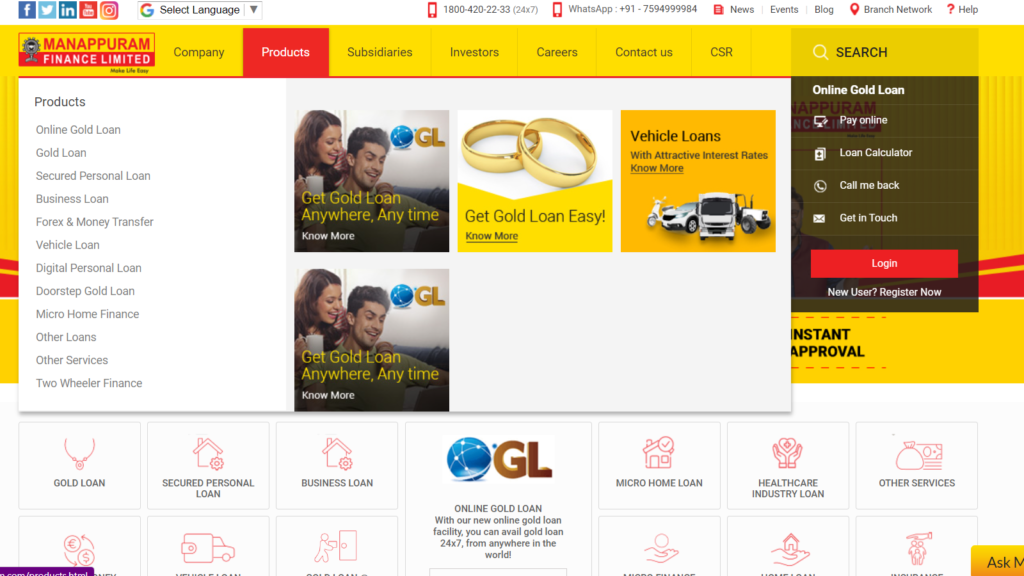

Products and services offered by Manappuram Finance

Manappuram Finance offers a variety of financial products and services, including:

- Gold loans

- Personal loans

- Business loans

- Home loans

- Education loans

- Insurance

The company also offers a variety of value-added services, such as:

- Doorstep collection

- EMI payment options

- Online loan application

- Mobile app

Target market of Manappuram Finance

The target market of Manappuram Finance is individuals and businesses who are looking for financial solutions. The company’s products and services are designed to meet the needs of a wide range of customers, including:

- Salaried professionals

- Self-employed individuals

- Small businesses

- Homeowners

- Students

Why Choose Manappuram Finance?

Here are some of the reasons why you should choose Manappuram Finance:

- Competitive interest rates: Manappuram Finance offers competitive interest rates on its loans. The interest rates are typically lower than those offered by banks, and they are also flexible, so you can choose a repayment plan that fits your budget.

- Quick and easy loan approval process: Manappuram Finance has a quick and easy loan approval process. You can apply for a loan online or at a branch, and you will typically receive a decision within a few days.

- Flexible repayment options: Manappuram Finance offers flexible repayment options. You can choose to repay your loan in EMIs (equated monthly instalments) or lump sum. You can also choose to prepay your loan without penalty.

- Wide network of branches across India: Manappuram Finance has a wide network of branches across India. This means that you can easily find a branch near you, and you can also get help with your loan from a Manappuram Finance representative.

How to Apply for a Loan from Manappuram Finance?

Here are the steps on how to apply for a loan from Manappuram Finance:

Eligibility criteria

To be eligible for a loan from Manappuram Finance, you must meet the following criteria:

- You must be a citizen of India.

- You must be at least 18 years old.

- You must have a valid proof of identity and address.

- You must have a steady income.

- You must have a good credit history.

Required documents

The following documents are required to apply for a loan from Manappuram Finance:

- Proof of identity (passport, PAN card, voter ID card, etc.)

- Proof of address (Aadhaar card, ration card, electricity bill, etc.)

- Income proof (salary slip, bank statement, tax returns, etc.)

- Credit history report (if available)

Application process

You can apply for a loan from Manappuram Finance online or at a branch. Here are the steps on how to apply online:

- Go to the Manappuram Finance website and click on the “Apply for a Loan” button.

- Select the type of loan you want to apply for.

- Enter your personal information, such as your name, email address, and contact number.

- Enter your financial information, such as your income and expenses.

- Upload the required documents.

- Click on the “Submit” button.

If you apply for a loan at a branch, you will need to provide the same information as you would if you applied online. The branch representative will also help you complete the application process.

Once you have submitted your application, Manappuram Finance will review your information and make a decision. You will typically receive a decision within a few days.

If your application is approved, you will be issued a loan agreement. You will need to sign the loan agreement and return it to Manappuram Finance. Once the loan agreement is signed, you will receive the loan amount.

Read Also – The Ultimate Guide to Financial Planning!

Customer Reviews of Manappuram Finance

Here are some positive and negative reviews of Manappuram Finance:

- “I was able to get a loan quickly and easily from Manappuram Finance. The interest rates were competitive and the repayment terms were flexible.”

- “The customer service at Manappuram Finance was excellent. They were helpful and answered all of my questions.”

- “I was able to get a loan even though I had a bad credit score. Manappuram Finance was willing to work with me.”

- “The interest rates on my loan from Manappuram Finance are high. I’m not sure if I’ll be able to afford the repayments.”

- “I had a problem with my loan from Manappuram Finance. The customer service was not helpful and I had to wait a long time to get my problem resolved.”

- “I was not happy with the way my loan was handled by Manappuram Finance. I felt like they were trying to take advantage of me.”

It is important to note that these are just a few examples of customer reviews. Your own experience with Manappuram Finance may be different.

Read More Details on Manappuram Finance Ltd Reviews by Mouthshut

Manappuram Finance has a mixed reputation. Some customers have had positive experiences with the company, while others have had negative experiences. It is important to do your research before you apply for a loan from Manappuram Finance.

FAQs

Manappuram Finance offers a variety of loans, including:

- Gold loans

- Personal loans

- Business loans

- Home loans

- Education loans

- Two-wheeler loans

- Car loans

- Loan against property

- Loan against salary

The interest rates on Manappuram Finance loans vary depending on the type of loan, the amount of the loan, and the borrower’s credit score. However, the interest rates are typically lower than those offered by banks.

Manappuram Finance offers flexible repayment options. You can choose to repay your loan in EMIs (equated monthly instalments) or lump sum. You can also choose to prepay your loan without penalty.

The documents required to apply for a loan from Manappuram Finance vary depending on the type of loan. However, the following documents are typically required:

- Proof of identity (passport, PAN card, voter ID card, etc.)

- Proof of address (Aadhaar card, ration card, electricity bill, etc.)

- Income proof (salary slip, bank statement, tax returns, etc.)

- Credit history report (if available)

The processing time for a loan from Manappuram Finance typically takes a few days. However, the processing time may vary depending on the type of loan and the borrower’s credit score.

The maximum loan amount you can get from Manappuram Finance depends on the type of loan, the amount of the loan, and the borrower’s credit score. However, the maximum loan amount is typically up to Rs. 50 lakhs.

The minimum credit score required to get a loan from Manappuram Finance is typically 700. However, the minimum credit score may vary depending on the type of loan and the borrower’s other financial circumstances.

The fees associated with Manappuram Finance loans vary depending on the type of loan. However, some of the fees that may be charged include:

- Processing fee

- Late payment fee

- Prepayment penalty

- Repayment charges

You can track your loan repayments with Manappuram Finance in a few ways:

- You can log in to your Manappuram Finance account online.

- You can call Manappuram Finance customer service.

- You can download the Manappuram Finance mobile app.

There are a number of benefits to using a Manappuram Finance loan, including:

- Competitive interest rates

- Quick and easy loan approval process

- Flexible repayment options

- Wide network of branches across India

- 24/7 customer support