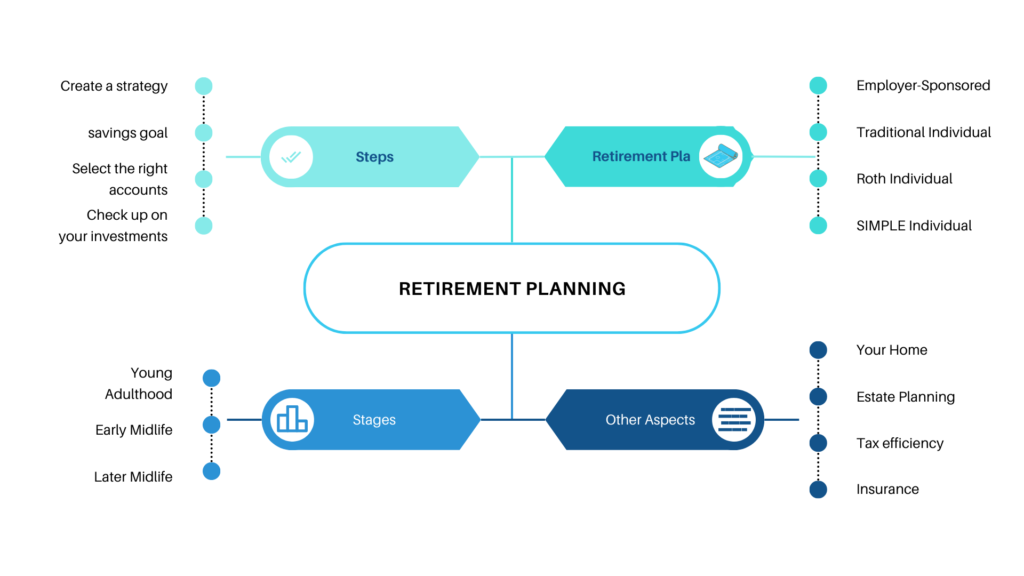

What Is Retirement Planning?

Retirement planning involves setting retirement income objectives and the resources required to meet those goals. Retirement planning entails identifying income sources, estimating expenses, putting a savings strategy in place, and managing assets and risks. Future cash flows are predicted to determine whether the retirement income target is achievable.

You can begin at any moment, but it is most effective if you incorporate it into your financial planning as soon as feasible. That is the most effective way to ensure a safe, secure, and enjoyable retirement. The fun aspect is why it’s important to focus on the serious and possibly dull portion: planning how you’ll get there.

KEY LESSONS

- It is never too early or too late to begin planning for retirement.

- Retirement planning refers to financial techniques for saving, investing, and eventually distributing money to support oneself during retirement.

- Many popular investment vehicles, such as IRAs and 401(k)s, allow retirement savers to grow their money while benefiting from tax breaks.

- Retirement planning considers future spending, responsibilities, and life expectancy in addition to assets and income.

- If you are under the age of 50, you can contribute up to $22,500 to a 401(k) in 2023 (up from $20,500 in 2022).

How Much Do You Need to Retire?

Retirement planning is a long-term process that should begin long before you reach the age of retirement. Starting early provides you more time to save and invest for your retirement. Your magic number, or the amount required to retire comfortably, is specific to your circumstances. Although there are some general guidelines that can help you determine how much you should save.

The amount you need to save for retirement varies depending on who you ask. Some individuals say that you need around a million dollars to retire comfortably, but others follow the 80% rule. This guideline states that you should have enough money to live on 80% of your salary in retirement. For example, if you make $100,000 per year, you will need funds that can yield $80,000 per year for around 20 years, or a total of $1.6 million, including the income generated by your retirement assets. Others argue that the majority of retires aren’t saving enough to meet those goals and should change their lifestyle to live within their means.

Aside from the amount of money, you’ll need in your emergency fund, it’s critical to consider all of your expenses. You should budget for accommodation, health insurance, food, clothing, transportation, entertainment, and travel. Although coming up with concrete figures may be difficult, making a reasonable estimate will help you avoid surprises later on.

Steps to Retirement Planning

No matter where you are in life, there are several critical measures you should take during your retirement preparation. These steps, which apply to practically everyone, are as follows:

- Create a strategy. Determine when you want to begin saving when you want to retire, and how much money you need to save for your long-term goal.

- Determine a monthly savings goal. Automatic deductions eliminate the need for guesswork, keep you on schedule, and eliminate the temptation to skip or forget to deposit money.

- Select the right accounts for you. If your employer offers a 401(k) or equivalent program, take advantage of it. Remember, if your firm offers an employer match and you don’t participate, you’re passing up free money. Furthermore, it is critical to have an emergency fund that can be quickly liquidated if you require cash.

- Check up on your investments regularly and make modifications as needed. When your lifestyle changes or you enter a new stage of life, you should review your investments. It’s always a good idea to make changes as needed to ensure that you’re on pace to accomplish your retirement goals.

Retirement Plans

Retirement planning involves choosing the right retirement account that suits your needs and goals. There are several retirement plans that you can choose from, depending on your needs and goals. These include:

Employer-Sponsored Plans

Employer-sponsored retirement plans are a common choice for young folks just starting.

401(k) plans are corporate retirement funds, whereas 403(b) plans are comparable plans used by public school employees and some charities. One advantage of these plans is that your company may match your contributions up to a specific amount, giving you an immediate boost to your retirement savings.

It is suggested, however, that you contribute more than the minimum required for the company match. Some financial experts recommend that you contribute up to 10% of your earnings. The maximum contribution limit for 401(k) and 403(b) plans for participants under age 50 in the 2023 tax year is $22,500 (up from $20,500 in 2022), with the possibility of additional employer matching. Participants over age 50 can contribute an extra $7,500 per year as a catch-up contribution.

Aside from the employer match, 401(k) plans provide additional benefits such as potentially earning a higher rate of return than a savings account, though the investments are not risk-free. The funds in the account are not subject to income tax until you withdraw them. Furthermore, your contributions are deducted from your gross income, which may reduce your tax liability if you are nearing the top of a tax bracket.

When selecting a retirement account, it is critical to consider your options and make informed decisions. Seeking financial advice can help you make the best decisions for your financial circumstances.

Traditional Individual Retirement Account (IRA)

Traditional individual retirement accounts (IRAs) allow you to save pre-tax cash, lowering your taxable income and tax burden. This account offers an immediate tax benefit, but when you withdraw funds from it, you will be subject to your usual tax rate at the time. The money in the account grows tax-free, and no capital gains or dividend taxes are assessed until you begin making withdrawals.

The IRS sets annual limits on how much you can contribute to a regular IRA based on inflation. The contribution ceiling for 2023 is $6,500, with individuals 50 and older able to invest an additional $1,000 for a total of $7,500. Distributions must be taken at the age of 72, but they can be taken as early as the age of 59 ½. If you withdraw before that age, you will be liable to a 10% penalty as well as taxes at your ordinary income tax rate.

Roth Individual Retirement Account (IRA)

A Roth IRA is a type of retirement account that is funded with after-tax earnings, making it ideal for young adults. Although there is no immediate tax benefit, it avoids paying a higher income tax when the funds are withdrawn in retirement. Starting a Roth IRA as soon as possible is advantageous since the longer the money is in the account, the more tax-free interest is earned.

The annual contribution limit for both Roth and standard IRAs is $6,500, or $7,500 if you are over 50. A Roth IRA, on the other hand, has income limits: if you are a single filer earning $129,000 or less per year as of the 2022 tax year ($138,000 in 2023), you can contribute the maximum amount. After that, you can invest to a lesser degree, up to an annual income of $144,000 in 2022 and $153,000 in 2023. The income limits for married couples filing jointly are higher.

A Roth IRA, like a 401(k), includes penalties for withdrawing funds before retirement age. There are a few exceptions, such as the opportunity to withdraw the initial capital without penalty and for specific needs such as schooling, first-time house buying, health care, and disability payments.

SIMPLE Individual Retirement Account (IRA)

The SIMPLE IRA, or Savings Incentive Match Plan for Employees, is a retirement account option for small business employees. When compared to the 401(k), this plan is less expensive for businesses to maintain. It works similarly to a 401(k), with employees automatically contributing money through payroll deductions and the opportunity of an employer match. The employer contribution is limited to 3% of the employee’s annual wage. The annual contribution limit for a SIMPLE IRA will be $15,500 in 2023, up from $14,000 in 2022. Individuals 50 and older can make an additional $3,500 catch-up contribution, bringing their total contribution limit to $19,000.

Stages of Retirement Planning

Here are some guidelines for successful retirement planning at various phases of your life.

Young Adulthood (Ages 21–35)

If you are in your early adulthood, which is often defined as between the ages of 21 and 35, it is critical to begin planning for retirement as soon as feasible. Even if you don’t have a lot of money to invest, the compounding principle can work in your favor. Because compounding allows your investments to earn interest on top of interest, the longer you save, the more money you can potentially earn. For example, investing $50 per month beginning at the age of 25 could be worth three times more than starting at the age of 45. While you may have more money to invest in the future, you can never make up for lost time, so getting started early is important.

Early Midlife (Ages 36–50)

This is an important phase of retirement planning since it is the last opportunity to make a significant contribution to savings before retirement. To decrease the risk of market volatility, people in their forties and fifties may wish to consider transferring part of their investments to more conservative options such as bonds or certificates of deposit.

At this point, you should also consider your estimated retirement expenses and modify your funds accordingly. This includes calculating healthcare costs, which tend to rise as you become older. If you have children, you should also consider college costs.

Finally, to reduce your retirement expenses, consider paying off any outstanding debts, such as mortgages or car loans. This will help you to retire with fewer financial worries and more peace of mind.

It’s also worth mentioning that as you approach retirement age, you should begin reassessing your retirement goals and altering your investment strategy accordingly. To protect your retirement savings, you may want to consider gradually changing your investments to lower-risk assets. When planning for retirement, don’t forget to account for potential healthcare costs and long-term care expenses.

Later Midlife (Ages 50–65)

As the period to save for retirement is running out, it is crucial to switch to more conservative investments during the later midlife stage (ages 50 to 65). However, this stage has advantages as well, such as higher wages and possibly fewer financial burdens, which means more disposable income to invest.

Individuals should take advantage of catch-up contributions, which allow them to contribute an extra $1,000 per year to a regular or Roth IRA and an extra $7,500 per year to a 401(k) in 2023. If they have exhausted their tax-advantaged retirement savings options, they can supplement their retirement savings with other types of investments such as CDs, blue-chip stocks, or certain real estate investments.

At this point, it is also vital to evaluate Social Security benefits and determine when it is appropriate to begin receiving them. Individuals may also consider long-term care insurance to help cover the costs of nursing homes or in-home care in their golden years. Unexpected medical costs can quickly deplete retirement savings, so adequate planning is essential.

Other Aspects Of Retirement Planning

Retirement planning involves considering your entire financial situation, not just how much you save or need for retirement.

Your Home

One crucial factor is your home, which is often the most valuable asset for most Americans. However, as a result of the housing market crash and an increase in home equity loans and HELOCs, many retirees are entering retirement with mortgage debt.

When you retire, you should consider whether your home is still adequate for your needs. If you have a huge home that was once packed with children but is now too large, you should think about downsizing or selling it. Keeping a larger home than you need can result in considerable expenses such as maintenance and property taxes. As a result, it’s critical to include your property in your retirement plan and decide what to do with it.

Estate Planning

Estate planning is an important part of retirement planning since it determines what happens to your assets when you die. It should include a will, a trust, or another estate-tax-avoidance scheme. The first $12.92 million of an estate is now exempt from estate taxes as of 2023, although this exemption threshold may alter in the future.

Tax efficiency

Tax efficiency is also important in retirement planning. Traditional 401(k) and IRA withdrawals are taxed as ordinary income, which could result in high tax rates. To avoid this, consider a Roth IRA or a Roth 401(k), which allows you to pay your taxes in advance. A Roth conversion may also make sense in some situations, especially if you anticipate increased income later in life. You can get help understanding these tax implications from an accountant or financial planner.

Insurance

It’s critical to consider asset protection when planning for retirement. Medical costs tend to rise as you become older, and navigating the Medicare system can be difficult. Because standard Medicare may not provide adequate coverage, many people choose to supplement it with a Medicare Advantage or Medigap policy. Long-term care insurance and life insurance are further options to consider.

Another sort of policy given by an insurance firm is an annuity. It operates similarly to a pension in that you deposit money with the insurance provider, who then pays you a specified monthly amount. When considering whether an annuity is an appropriate choice for you, there are several alternatives and factors to consider.

FAQ

When should I start planning for retirement?

It’s never too early to start planning for retirement. The earlier you start, the more time you have to save and invest for your retirement. Ideally, you should start planning for retirement in your 20s or 30s, but it’s never too late to start.

What is the best way to save for retirement?

The best way to save for retirement is to start early and contribute regularly to your retirement accounts. This could be through an employer-sponsored 401(k) plan or an individual retirement account (IRA). You should also consider diversifying your investments to manage risk and achieve your retirement goals.

How much should I save for retirement?

The amount you should save for retirement will depend on your lifestyle, goals, and expenses. A general rule of thumb is to save at least 10-15% of your income for retirement. However, this may not be sufficient for everyone. You should use retirement calculators and work with a financial advisor to determine how much you need to save for retirement.

Why Is Retirement Planning So Important?

Retirement planning allows you to save enough money to continue your current lifestyle. After all, no one likes to work until the very end. While you may work part-time or pick up odd jobs here and there, it will most likely not be enough to support your current lifestyle. And Social Security will only get you so far. That is why it is critical to have a feasible strategy in place that allows you to receive the most amount of money when you retire.

The Bottom Line

retirement planning is necessary regardless of your age or financial situation. The earlier you start, the better, as your investments will grow over time, earning interest on interest. Planning ahead ensures that you have enough money to retire comfortably and enjoy the golden years of your life without financial worries.