Investing is one of the smartest decisions you can make when it comes to developing your money and planning for your financial future. The advantages of wise investing are numerous. Investing, when done wisely, can help you outpace increasing inflation and generate wealth on your own terms.

Furthermore, when successful assets are reinvested, they can generate earnings, allowing your initial investment to multiply over time.

All of this is to imply that the rewards of investing can be substantial if you do your homework ahead of time and be mindful of your budget and the riskiness of the investment.

The following list highlights the greatest investments for 2023, incorporating both long-term and short-term investments, as well as the varied levels of risk for each. While there are other great investment possibilities, these 15 take growing inflation and interest rates into account while providing options for both high and low-risk investors.

The 15 Best Investments for 2023

1. Value Stocks

Affordable opportunities for patient investors

Value stocks are undervalued and sometimes ignored by investors, but if you’re patient, they can provide substantial rewards. Ideal for higher-risk investors seeking long-term returns.

Risks: Value equities are riskier than growth stocks since they vary more than bonds. You’re banking on a company that many investors may dislike.

Rewards: When interest rates rise, value investments outperform growth companies.

Where to buy: Buy value stocks through online brokers.

2. Cryptocurrency

High risks, high rewards

Cryptocurrency has grown in popularity due to its price volatility, which is impacted by supply, demand, and media attention.

Best for: Risk-averse investors looking for potentially significant payouts. Cryptocurrency can lead to great wins, but it can also see its value plunge.

Risks: include the possibility of losing everything. Coin values can fluctuate dramatically.

Rewards: Despite a decline in 2022, the cryptocurrency market has expanded enormously. Long-term investors have made huge gains.

Where to buy: Crypto can be purchased through traditional brokers as well as online exchanges such as Coinbase.

3. Small-Cap Stocks

Investing in future success

Small-cap stocks are companies valued between $500 million and $1 billion, with an emphasis on future growth.

Large-cap equities worth more than $10 billion may have slower growth but still have tremendous upside potential. Small-cap stocks are typically linked with newer businesses.

Best for: High-risk investors who plan to hold their investments for a long time. Investing in small-cap stocks entails betting on a company’s continued growth.

Risks: While inflation and recessions can be difficult for young businesses with minimal resources, they can overcome hardship.

Rewards: When compared to large-cap equities, small-cap investments typically have higher growth potential.

Where to buy: Online brokers sell small-cap stocks.

4. Corporate Bonds

Stable investments with high dividends

Corporate bonds, which are frequently issued by successful corporations, can offer appealing yields, particularly when bond yields are reaching multi-year highs. They are often less hazardous than stocks because they rely on the issuing company’s continuous profitability.

Best for: Intermediate-risk investors looking for steadiness. When compared to stocks, corporate bonds are a less volatile investment alternative.

Risks: When interest rates rise, bond prices fall. Because bond interest rates are fixed, the bond’s value will not rise with rising rates, resulting in a lesser worth.

Rewards: Corporate bonds are less volatile than stocks and can potentially yield more than government bonds.

Where to buy: Bonds can be purchased through major brokers such as Fidelity and Charles Schwab.

5. Dividend Stock Funds

Diversified investments with regular payouts

Dividend stock funds, whether mutual funds or exchange-traded funds (ETFs), invest in dividend-paying equities to provide diversification across multiple companies.

By investing in dividend funds, you are betting on the fund’s firms’ continuous success, which may result in regular payouts, often on a quarterly basis.

Best for: Those looking for both share price increase and regular dividends. Dividend stock funds have the possibility for quarterly cash dividends as well as share price appreciation.

Risks: If a fund firm experiences a crisis and ceases to generate earnings, you may incur losses since there will be no dividends to payout. Furthermore, dividends are never guaranteed and are paid out contingent on the financial performance of the company.

Rewards: When investing in profitable companies, you can receive regular cash payouts. Your investment can profit if the company continues to generate profits.

Where to buy: Purchase dividend stock funds through brokerage firms.

Read Also – What Are Dividends And How Do They work?

6. Robo-Advisor Portfolios

Efficient and accessible investment tools

Robo-advisors are artificial intelligence-powered solutions that use algorithmic software to maximize returns in accordance with modern portfolio theory.

The business has grown significantly over the last decade, particularly among younger investors. Robo-advisors are enticing alternatives to human financial advisors due to their 24-hour availability and low cost.

Best for: Investors looking for a low-cost, easy solution with 24-hour access. Robo-advisors are a low-cost, high-efficiency replacement to human advisors.

Risks: One of the most common criticisms leveled against robo-advisors is the lack of human emotion and tailored assistance. During severe market downturns, robo-advisors may not provide the same level of comfort and assistance as human advisors.

Rewards: Robo-advisors are inexpensive and available around the clock. They apply well-known investment theories, increasing the possibility of profit.

Where to buy: Robo-advisors can be found on automated investment sites like Betterment, Wealthfront, Interactive Advisors, and Stash.

7. Growth Stocks

Potential for future gains

Growth stocks are shares in firms that are predicted to rise faster than the broader market. These businesses reinvest their profits rather than paying dividends.

Growth stocks entice investors because they can profit from capital gains by selling the stock at a higher price in the future. Investing in growth stocks is essentially betting on undervalued firms with future growth potential.

Best for: Market-savvy investors with a strong awareness of market movements and a higher risk tolerance. Choosing the best growth stocks necessitates recognizing companies that are well-positioned to profit from the current market.

Risks: Because growth stocks do not pay dividends, profits are generated by selling shares. Selling may result in losses if the company underperforms.

Risks: Growth stocks don’t pay dividends, so profits come from selling shares. If the company underperforms, selling may result in losses.

Rewards: Companies can experience prolonged revenue growth. Holding onto growth stocks can lead to substantial gains when selling in the future.

Where to buy: Purchase growth stocks through online brokers like E*Trade or Robinhood.

Read Also – How To Buy Tesla Stock On Etoro

8. Real Estate/REITs

Long-term investment with potential for high returns

Real estate investing demands significant upfront money but yields tremendous returns.

You don’t have to have a lot of money to invest; bank loans allow you to pay off the investment over time.

Real estate investment trusts (REITs) offer an alternative for those who do not want to own or manage real estate. REITs are corporations that possess commercial real estate and pay out large dividends.

Best for: Investors that are committed to long-term investments and property maintenance. Real estate requires time commitment, but REITs offer an alternative for individuals looking for a more hands-off approach.

Risks: Because of their greater costs, real estate investments lack portfolio diversification, potentially leaving investors with few options. Borrowing money for real estate ventures increases the risk. REITs may provide more diversification opportunities.

Rewards: Well-chosen and well-managed properties can yield significant profits, compounded over time.

Where to buy: Purchase REIT shares through brokerage firms.

Read Also – DB Realty Real Estate Share Price

9. Target-Date Funds

Simplified retirement investing

Target-date funds are retirement funds that allocate investments based on a chosen target retirement date, taking care of risk balancing for you.

Best for: Individuals saving for retirement.

Risks: Target-date funds are subject to stock market fluctuations and the impact of inflation, which can affect income.

Rewards: Target-date funds automatically diversify your assets, eliminating the need for manual portfolio diversification.

Where to buy: Target-date funds are commonly invested in through company 401k plans.

10. S&P 500 Index Fund

Broad market exposure for long-term gains

Investing in the S&P 500 means investing in the 500 largest companies by market capitalization, offering potential long-term profitability.

By investing in the S&P 500, you automatically diversify your portfolio across a wide range of companies.

Best for: Beginner investors seeking a long-term investment strategy. Investing in the S&P 500 doesn’t require extensive market knowledge, as it represents established, successful companies.

Risks: While the S&P 500 is a relatively lower-risk investment, it is still subject to market volatility due to its composition of stocks.

Rewards: The S&P 500 provides exposure to a diverse set of companies from various industries.

Where to buy: Invest in the S&P 500 through any stock broker.

11. Certificates of Deposit (CDs)

Low-risk investment with guaranteed returns

CDs involve investing a lump sum for a specific period, earning interest without market volatility.

Best for: Low-risk investors seeking a guaranteed return on investment.

Risks: Early withdrawal may incur penalty fees.

Rewards: CDs provide a guaranteed return at maturity.

Where to buy: Purchase CDs through your bank or credit union.

12. High-Yield Savings Accounts

Higher returns with stability

High-yield savings accounts offer a higher annual percentage yield (APY) compared to traditional savings accounts, resulting in increased payouts.

These accounts provide the stability of being federally insured.

Best for: Investors seeking quick returns on small investments, as high-yield savings accounts often have low minimum deposit requirements or none at all.

Risks: High-yield savings accounts may not keep pace with inflation, making them less suitable for long-term goals such as retirement savings.

Rewards: High-yield savings accounts are FDIC-insured, ensuring deposits up to $250,000 are protected in the event of bank failure.

Where to buy: High-yield savings accounts are available through online banks and traditional banks with multiple branches.

13. Roth IRA

Tax-free growth for retirement savings

Roth IRAs provide an excellent option for retirement funds. Similar to traditional IRAs, they allow long-term growth of your retirement savings. The key difference is that with a Roth IRA, you can withdraw your funds tax-free during retirement.

Best for: Roth IRAs are ideal for individuals starting to save for retirement. It is advisable to consider using a Roth IRA whenever you begin saving for retirement.

Risks: Early withdrawals from a Roth IRA may incur a 10 percent penalty on earnings.

Rewards: With a Roth IRA, you can invest in stocks and stock funds without incurring taxes on the gains. While returns may vary, the tax-free nature of a Roth IRA can lead to higher payouts when investments perform well.

Where to buy: You can open a Roth IRA through various brokerage firms or at a bank.

14. Fixed Annuities

Guaranteed income with low risk

Fixed annuities offer the opportunity to receive guaranteed compensation by making a set payment. They come with fixed interest rates and a predetermined rate of return, providing certainty in the amount of income you will receive. Unlike other investments, the income from fixed annuities is not dependent on market fluctuations.

Best for: Fixed annuities are suitable for individuals in or approaching retirement. The consistent income stream they provide ensures financial stability after retirement.

Risks: Accessing the funds before the maturity date of the annuity may result in penalty fees. Withdrawals from fixed annuities are typically restricted.

Rewards: Fixed annuities offer stability by eliminating market volatility. The income is received regularly, providing peace of mind.

Where to buy: Fixed annuities can be purchased through brokerage firms.

15. Money Market Mutual Funds

Low-risk investments with stable returns

Money market mutual funds are a type of fixed income mutual fund that primarily invests in debt securities with minimal credit risk. These investments are considered safer due to the regulatory requirements imposed on the debt securities held by the fund, ensuring a certain level of quality, liquidity, and maturity.

Best for: Money market mutual funds are well-suited for low-risk investors seeking quick access to cash. While the returns may not be as high as other investments, the risk and volatility are significantly lower.

Risks: Money market funds are not government-issued, which means there is a risk of losing your investment if the bank or institution holding the fund goes bankrupt.

Rewards: Money market mutual funds offer stability and low volatility, providing a high likelihood of positive yields.

Where to buy: Money market mutual funds can be purchased through brokerage companies or mutual fund firms.

Read Also – How To Start Investing In Your 20s

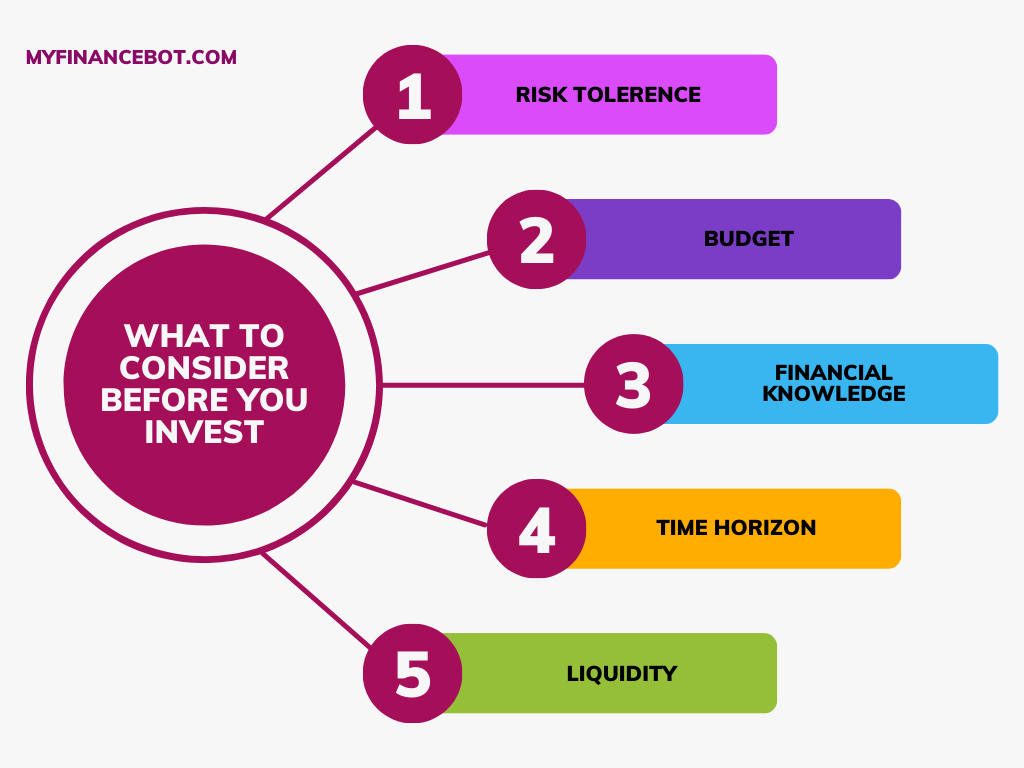

What To Consider Before You Invest

Choosing where to invest is affected by a number of factors, the majority of which are unique to you, your financial circumstances, and external market conditions. Here are some things to think about before investing.

Risk Tolerance

Investing is all about risk tolerance. It’s like a roller coaster ride where some people crave the thrill, while others prefer a more steady journey. Take cryptocurrency, for instance. It’s like a wild adventure, attracting those bold risk-takers who chase high rewards amidst the ups and downs. On the other hand, the S&P 500 offers a smoother ride, appealing to cautious investors seeking stability in their financial journey. Both approaches have their merits, but they cater to different investing styles. High-risk ventures may bring lucrative gains, but they also carry the potential for heart-stopping losses. It’s all about finding the right fit for your risk appetite and embarking on an investment journey that suits your personal roller coaster preference.

Budget

Your financial budget plays a crucial role in determining your investment options. It’s important to be realistic about what you can afford. For instance, diving into the world of real estate might not be feasible for beginner investors due to the significant capital required. However, there are lower-budget alternatives, such as value stocks, where you anticipate the stock price to increase over time.

Keep in mind that certain high-profile stocks like Berkshire Hathaway or Amazon may be beyond the reach of some investors due to their hefty price tags. Your budget will ultimately influence the stocks you can invest in and the number of shares you can purchase. It’s essential to align your investment decisions with your financial capabilities to make prudent choices that suit your budgetary constraints.

Financial Knowledge

It’s important to assess your own financial knowledge before making investment decisions. Investing in growth stocks, for instance, demands a deep understanding of market trends and the ability to identify companies with strong growth potential.

On the other hand, the S&P 500 simplifies the process for you. The companies included in this index have a track record of success, and it doesn’t require extensive financial knowledge to recognize that investing in them carries a relatively lower level of risk.

Time Horizon

Before diving into any investment, it’s crucial to consider your investment timeline. Ask yourself, “When do I need the money?” Different investments offer varying timeframes for potential returns.

For instance, investing in small-cap stocks entails betting on the future growth of young companies. However, the timeframe for realizing substantial returns can be unpredictable and often extends over a longer period.

Similarly, value stocks rely on the expectation that market valuations of certain companies will change over time. To benefit from these investments, you must be patient and willing to wait for the market to recognize their value.

Liquidity

Liquid assets refer to earnings that can be readily converted into cash. The level of liquidity varies across different types of investments. Stocks and bonds, for example, are highly liquid as they can be sold at any time, allowing you to access your funds quickly.

On the other hand, real estate is considered one of the least liquid assets. It typically takes a longer time to see returns and may require a more extended process to convert the investment into cash.

What is the Safest Investment in 2023?

While there is no one-size-fits-all approach to investing, the safest investment for you boils down to weighing your goals, budget, risk tolerance, and how long you’re willing to wait on returns. Having a strategy in place before you invest is essential to seeing the results you desire.

FAQs

What are the top stocks to buy in 2023?

2023’s Best Growth Stocks to Buy and Hold Rajiv Jain, a billionaire, believes

Adobe Inc. (NASDAQ:ADBE)

Visa Inc.

Meta Platforms, Inc. (NASDAQ:META)

Eli Lilly and Company (NYSE:LLY)

Advanced Micro Devices, Inc. (NASDAQ:AMD)

ServiceNow, Inc. (NYSE:NOW)

Microsoft Corporation (NASDAQ:MSFT)

Which stock will give good returns in 2023?

Best Stocks to Buy in 2023

1. Reliance Industries, Inc.

2. Tata Consultancy Services (TCS)

3. HDFC Bank

4. Infosys

Which market will grow in 2023?

Best Investment Sectors for 2023

1. Housing Finance

2. Banking

3. Energy

4. Transportation.

Sourcing

- Source link of this post “The 15 Best Investments for 2023” intuit. (December 2022)

- Investing is a good way to outpace rising inflation. “Investing in the stock market is more important than ever amid rising inflation” CNBC. (March 2022).

- Cryptocurrency is available through both traditional brokers and online exchanges. The Motley Fool. (September 2021).

- Corporate bonds are near multi-year highs. “4 Reasons to Consider IG Corporate Bonds Now.” Charles Schwab. (August 2022).

- Corporate bonds may yield greater returns than government bonds. “Corporate bonds: Here are the big risks and rewards.” Bankrate. (June 2022).

- CDs are federally insured. “Are Certificates of Deposit (CDs) FDIC-Insured?” Smartasset. (March 2022).

- Deposits in high-yield savings accounts up to $250,000 are protected in the event of bank failure. “What a high-yield savings account is and how it can grow your money.” CNBC. (September 2022).

- Robo-Advisors use modern portfolio theory to offer financial advice. “Modern Portfolio Theory: What MPT Is and How Investors Use It.” Investopedia. (September 2021).

- Robo-Advisors have been criticized for lacking human emotion. “Why robo-advisors are striving toward a ‘hybrid model,’ as the industry passes the $460 billion mark.” CNBC. (April 2021).

- You can create a target-date fund through your 401K plan. “Target-date funds are assets that are designed to offer long-term growth by a set time.” Business Insider. (August 2022).

- CDs pay interest out over a set period of time. “What Is a Certificate of Deposit (CD) and What Can It Do for You?” Investopedia. (May 2022).