If you’re new to investing, the first decision you’ll have to make when creating an investment account can be daunting: which form of investment account should you open? The truth is that several sorts of accounts are available for varied purposes. Let’s take a look at the most frequent ones that most bargain brokerages provide.

Consider an investing account to be a car, with your actual investments as passengers. Each form of account has its own restrictions on the quantity and types of investments it can hold, as well as its own set of rules. You can keep stocks, bonds, mutual funds, and other financial items in the account. Contribution limits apply to some accounts, and certain types of investments may be prohibited in others.

Firstly, there are two types of accounts: brokerage accounts and retirement accounts. There are also some specialist accounts. You can deposit and withdraw monies from your brokerage account at any time. Retirement accounts, on the other hand, have yearly investment limits and typically limit withdrawals until retirement.

Both sorts of accounts have their own set of benefits. With a brokerage account, you have the freedom to invest in a wide choice of goods, including the opportunity to employ leverage and take short positions. Retirement accounts have investment restrictions but often come with tax benefits.

When deciding on the type of investing account that is appropriate for you, it is critical to examine your goals and needs. Understanding these characteristics will help you navigate the many possibilities and make an informed decision.

The Types Of Investment Accounts To Open

Brokerage Investment Accounts

Cash – A cash brokerage account, also known as a normal brokerage account, is the most basic type of investing account. It works on the basis of the funds you deposit into the account. A cash brokerage account allows you to invest only with the available cash amount in the account. Because of this restriction, you are unable to engage in certain options trading or short selling. If you are interested in these types of trading activities, you might think about opening a margin account.

It is vital to realize that all transactions made within a cash brokerage account are taxed. As a result, it is critical to choose your assets prudently, taking into account the potential tax effects.

Margin – A margin account is comparable to a cash account, except it also allows you to trade on margin. This means that when you place a trade, you can borrow money from the brokerage. It is crucial to note, however, that a margin account still requires some capital and normally allows you to borrow up to 50% of the value of your existing investments.

Having a margin account allows you to engage in a variety of trades, including options trades and short selling. This increased capability is made feasible by your ability to borrow funds from the broker to execute these deals. Because trading on margin involves borrowing and leverage, it is critical to be aware of the dangers involved.

Margin account transactions are taxed in the same way as cash account transactions are. As a result, when using a margin account, you must consider the potential tax implications of your trading activities.

Retirement Investing Accounts

There are numerous ways to invest available for saving for retirement. IRAs are the most common type of open account. You may be aware of the terms 401k and 403b, but those are employer-sponsored plans that individuals do not open.

Traditional IRA – A Traditional IRA (individual retirement account) is a type of retirement savings account that allows you to save and invest for retirement up to the IRA contribution limitations. The advantage of using a Traditional IRA is that the amount you donate is often tax deductible. Everything you do or trade after you deposit money into the account is tax deferred. You only pay taxes on the money you withdraw in retirement, and you do so at standard income tax rates.

Roth IRA – A Roth IRA works similarly to a Traditional IRA, with one important difference: you contribute to a Roth IRA with after-tax dollars. Both forms of IRAs operate in the same way within the account. The benefit of a Roth IRA, on the other hand, is the tax treatment of withdrawals during retirement.

When you withdraw funds from a Roth IRA in retirement, you do not have to pay any taxes on the money you take out. This can be advantageous in comparison to a Traditional IRA, where withdrawals are normally taxed at your regular income tax rate.

Choosing between a Roth IRA and a Traditional IRA requires taking into account your present and future tax brackets. If you are now at a higher tax rate and expect to be in a lower tax bracket when you retire, a Traditional IRA may be more beneficial because you receive tax benefits on your contributions today. A Roth IRA, on the other hand, is usually the better choice if you are currently in a lower tax rate and plan to be in a higher tax bracket in retirement.

SEP IRA – A SEP IRA, or Simplified Employee Pension Individual Retirement Account, is developed exclusively for self-employed individuals. It’s a terrific choice for freelancers, side hustlers, and anyone who works for themselves. Opening a SEP IRA is a simple and quick process.

The high contribution limit is one of the primary benefits of a SEP IRA. As a self-employed person, you may contribute up to 25% of your earnings to this account. This allows for significant savings as well as potential tax benefits. The SEP IRA is a crucial retirement savings option for self-employed individuals.

401k – A 401k is a retirement investing account that is typically provided by an employer or is open to self-employed persons (Solo 401k). It has one appealing feature: the contribution limitations are significantly larger than those of an IRA. Employers and employees can both contribute to a 401k account, and some employers even match contributions. As a result, a 401k is an excellent choice for retirement savings.

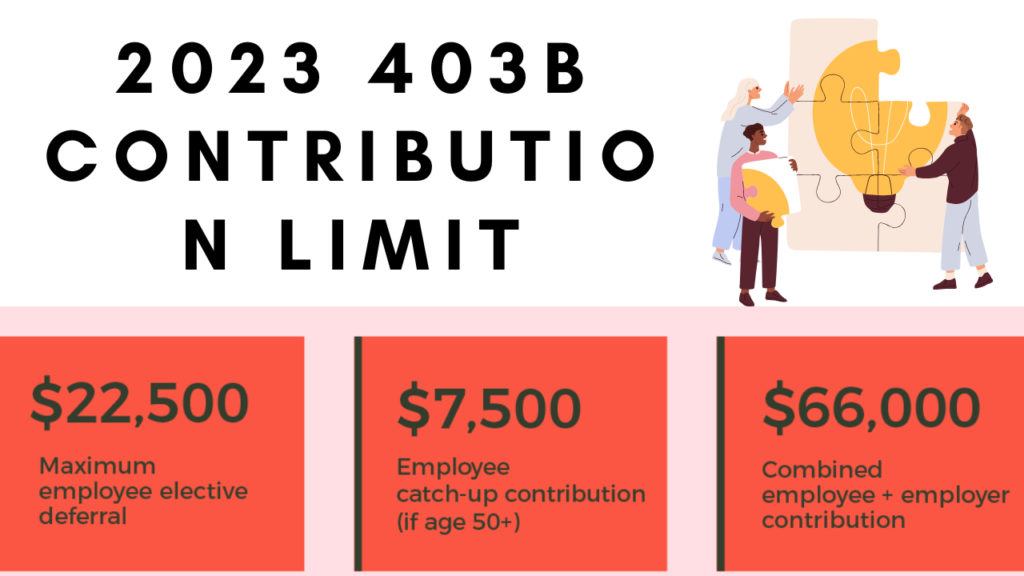

403b – A 403b retirement plan, like a 401k plan, is a retirement savings option provided by companies. The fundamental difference is that a 403b is meant particularly for employees of non-profit organizations or tax-exempt companies.

Contribution restrictions in a 403b plan are the same as in a 401k plan. Employees can contribute a portion of their earnings to a 403b account and potentially receive tax benefits. Furthermore, many firms that provide 403b plans may offer matching contributions, raising employees’ retirement savings even further.

Education Savings Accounts

529 Plan – A 529 plan is an education savings account that was previously used largely for college but is now also available for K-12 tuition, student loans, and other eligible expenses. This account has an owner (often a parent or grandparent) and a beneficiary (typically a child). It’s a fantastic mechanism that permits money to grow tax-deferred within it, and it’s tax-free when used for specified expenses. Furthermore, most jurisdictions give a tax benefit for contributions.

Coverdell Education Savings Account – A Coverdell Education Savings Account, formerly known as an Education IRA, is a different way for families to save for K-12 and college expenses. Coverdell accounts, while less common than 529 plans, have advantages in terms of eligible expenses. They are, however, constrained by lower contribution restrictions.

Health Savings Accounts

A Health Savings Account, or HSA, is a popular way to save for both medical and retirement needs. Because of the triple tax benefit of this account, many people use it as an IRA rather than for healthcare.

As long as you qualify, you can start an HSA for yourself outside of your company. You can also transfer existing HSAs to a new account. Check out our list of the best HSA providers.

Which Type of Investment Account Should I Open?

If you’re a new investor with a lengthy time horizon, focusing on retirement funds is a good idea. These accounts provide significant tax advantages and are intended for long-term investment plans.

A margin account, on the other hand, would be more appropriate if your goal is to actively engage in stock market speculation or pursue more complex investment methods. It acts similarly to a cash account, but with the added flexibility required for such operations.

Furthermore, if your goal is to save and invest for the future, you must take advantage of any “free money” chances. This implies that if your employer provides a 401(k) match or a Health Savings Account (HSA) match, you should contribute and take advantage of these benefits.

FAQs

What are the main types of investment accounts?

Investors in the United States who want to achieve financial goals by investing in stocks have four options: brokerage accounts, Individual Retirement Accounts (IRAs), education accounts, and employer-sponsored retirement plans.

What are the 3 types of investment accounts?

3 of the Most Common Types of Investment Accounts

Accounts for General Investing.

Accounts for Retirement

Education Savings Accounts (ESAs).

What is investment accounting and explain its types?

Investment accounting is a subset of accounting that is concerned with tracking and monitoring investment activity. Investment accountants often work for financial organizations such as banks or credit unions, although they can also operate as independent contractors or as part of an advisory business.

What information do you need to open an investment account?

A broker will most likely request the following information from you:

Your name.

Social security number (sometimes known as a tax identification number)

Address.

A phone number.

The email address.

The date of birth.

Information from a driver’s license, passport, or other government-issued identity.