I had an intriguing talk at the Crossfit gym around ten years ago. I was “rolling out” with my normal group of guys, using a foam roller to break up tissue, when one of my buddies mentioned this new thing called Bitcoin.

“Bitcoin is digital money,” he said. “But it’s completely private and not tied to a government.”

“How does that work?” I asked. From the very first moment I heard about cryptocurrency, it didn’t seem to make any sense. My friend tried to explain. We all chatted about it for a few minutes, and then we lifted heavy weights and/or sweated extensively and/or both of the above.

When I came home, I looked into Bitcoin. Nothing that I read made sense to me. I double-checked the price. At the time, Bitcoin was going for around $7 or $8.

I’ve been inundated with information on Bitcoin and cryptocurrency throughout the last decade. I’ve made an attempt to educate myself, to learn why people value cryptocurrency and believe it is the future of money. I still haven’t found an explainer who has explained things well enough for me to completely grasp.

This 21-minute Slidebean video was most helpful in teaching me the fundamentals of blockchain and cryptocurrencies, but it still didn’t convince me that this stuff was valuable.

Despite this, I’ve seen myself increasingly deteriorating over time. Many people support cryptocurrency, including those who appear to be sophisticated and intelligent. Kim’s brother, for example, is a big supporter of Bitcoin. He and his wife have made tens of thousands of dollars from cryptocurrency trading. (With earnings from one deal, they purchased a new SUV.)

So, last fall, I succumbed to the mania.

Doubling Down on Dumb

Last year, after selling our house and purchasing a new one, I had a huge sum of money in my checking account. I intended to invest this money in index funds in the future, but I kept it in cash until we settled into our new house. I used the money to buy furnishings and repair the roof, among other things.

Last November 23rd, I decided to undertake a small experiment. I thought that the best way for me to learn about cryptocurrencies was to actually purchase some. So I did. I put $5000 each into five different “coins” — a $25,000 investment. I bought Ehtereum (ETH), Cosmos (ATOM), Enjin (ENJ), Cardano (ADA), and Solana (SOL). Don’t ask me why I chose these particular coins. I had reasons at the time, but I can no longer remember them.

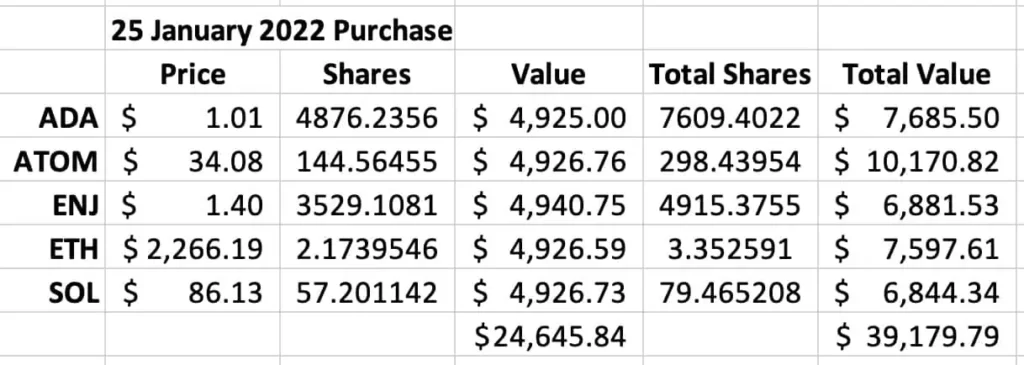

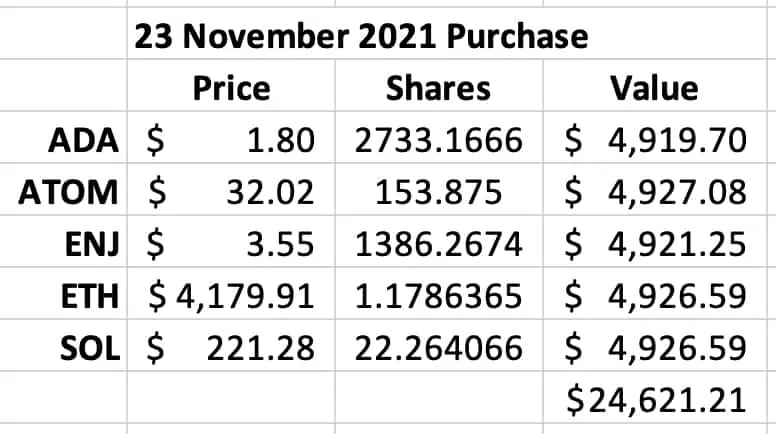

Here are my transactions.

Astute readers will ask, “If you bought $5,000 chunks of each coin, how come you only had about $4925 in each after the purchase?” I’ll explain why: transaction fees in the crypto industry are exorbitant. I utilized Coinbase as my “wallet” and trading platform, and they took a significant portion of every transaction. This should raise a red flag. (Or, at the very least, a yellow flag.)

I began to feel apprehensive after transferring this money into cryptocurrency. This was attributed in part to the weakening cryptocurrency market. When you’re losing money, you’re bound to feel nervous, right? But the greater issue was that I realized I’d done something stupid.

One of my cardinal investment rules (for myself) is to never invest in something I don’t understand. This guideline was taught to me by billionaire Warren Buffett (one of my personal financial heroes), who uses it in his own investment decisions. Buffett has famously lost out on some huge companies, such as Google and Amazon, since he didn’t grasp how their businesses operated and hence didn’t invest. He’s fine with it. He’d rather miss out on some winners than get pulled into a losing streak. That attitude appeals to me, and I frequently apply it to my decisions. Usually.

This time, however, I watched as the value of my Bitcoin fell.

I was torn. Part of me wanted to sell, to get out from under the mental weight of this “investment”. But another part of me hated the idea. “I bought high,” I told myself. “I shouldn’t sell low.”

By January, the value of my $25,000 in bitcoin had dropped to roughly $15,000. I didn’t want to sell at a loss of $10,000. So I doubled down on stupid. On January 24th, following a significant drop in the cryptocurrency market, I invested another $5000 in each of these five coins. (I justified it as dollar-cost averaging.)

That’s right: I “invested” $50,000 over the course of two months in something I didn’t understand and didn’t believe in, something I essentially viewed as a pyramid scheme. There’s no need to tell me how stupid I am. I’m already aware.

An Escape Hatch

February and March were agonizing. Cryptocurrency prices remained essentially stable, albeit on a downward trend. I was afraid that a major crash would occur and wipe out all of my savings. Prices then rose for a week or two around the time my cousin Duane’s health began to deteriorate at the end of March. I noticed an opportunity. I got rid of everything.

On March 31st, I transferred $47,750.49 back into my checking account. That is not the $50,000 I started with, but it is close. (Remember how I sold $48,409.91 but only made $47,750,49? Once again, transaction fees cost me a fortune. This appears to be a scam within a scam.)

I suppose my crypto tale is typical of most (though potentially with higher sums of money). I wasn’t going to invest. I was just speculating. I watched friends making tens of thousands of dollars with this new technology and wanted in on the action. So, despite not understanding how it all worked, I invested in the cryptocurrency market. I was betting.

In retrospect, I was fortunate. Yes, I lost $2249.51 in four months, but it was much less than I could have lost.

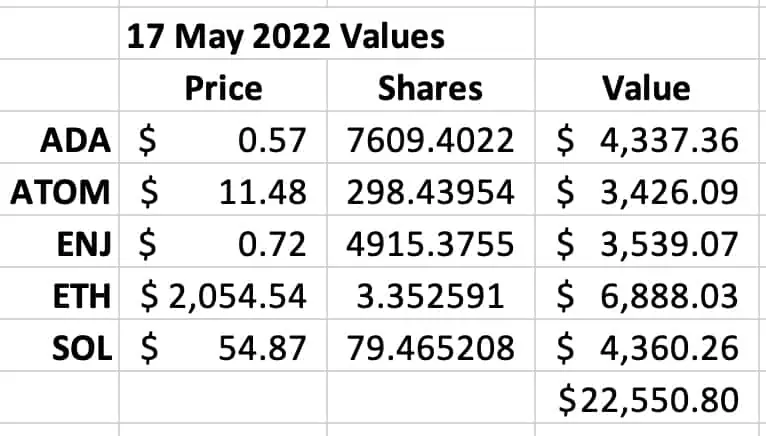

What if I had been so preoccupied with Duane that I had ignored my cryptocurrency? What if I sold today instead of at the end of March? That is an excellent question. Let’s look at what my portfolio value would be as of this very moment (about 08:00 on 17 May 2022):

If I had not sold, the value of my coins would be less than half what they were six weeks ago.

And look at this! Here’s what the value of my crypto portfolio would be today if I hadn’t made the January purchase and the March sale. Here’s what my original $25,000 “investment” would be worth if I’d simply bought and held.

That’s a 68% drop. Holy cats!

Investing in What I Know

Now I absolutely see that I’m not taking the long picture here. I’m “day trading” as it were. This is something I would advise against in the stock market, and I’m sure there are some who would advise against it in the crypto realm as well. This is a long game for these people. And perhaps they are correct. Perhaps prices will rise once more. They most likely will at some point. However, the more I study about bitcoin, the less I understand, and the more thankful I am that I escaped when I did.

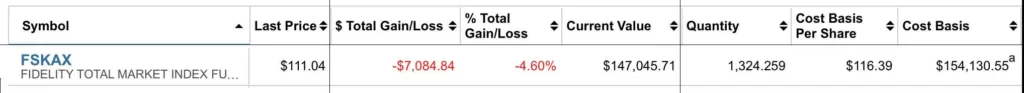

If this is the wave of the future, great. I’m glad some folks will make a lot of money on it. I’m not going to be one of those folks. After an ill-advised mis-adventure, I’ve returned to investing in what I know. On April 27th, I moved most of my remaining cash from the house sale ($154,130.55) into a total market index fund (which, coincidentally, has also lost value haha).

But here’s the catch. Stock market paper losses don’t disturb me. I know how the stock market works. I understand that the stock market permits me to buy small pieces of large corporations, corporations with actual storefronts, factories, and datacenters, corporations with customers, sales, and revenues. I am confident that investing in a broad-based index fund will allow me to participate in the long-term development (and short-term losses) of the global business community. This makes perfect sense to me.

But what about crypto? I’m still baffled by it. And, when I learn more about it, it appears to be a big pyramid scheme. After a brief journey into the realm of cryptocurrency, I’ve opted to pass. I’ll sit this one out.

But wait! What if I’d purchased Bitcoin 10+ years ago when I first heard about it? What if I’d, say, purchased 100 “coins” at $8 each, made an $800 investment? Well, this morning Bitcoin is trading at about $30,000 per coin. If I had 100 coins, they’d be worth $3,000,000. That’s a lot of money!

But this what-if scenario assumes that I would have held those hundred coins from the time I first heard about them until today. The odds of that having happened are almost zero. If I had purchased 100 coins at $8 each, I would have sold them long, long ago. I would have sold them before they reached $800. Or $80. I probably would have sold them once they reached $18.

What to do if you lost money in crypto?

If you lost money on cryptocurrency in 2022, you can write it off on your tax return. To deduct a capital loss, you must have actually sold assets.

Is it normal to lose money in crypto?

A greater proportion of bitcoin investors have lost money than made money. 38% of Americans who have held the money say they sold it for less than they paid for it, while 28% think they earned a profit. Only 13% claim to have made a profit.

Can you get money back on crypto losses?

You can only claim capital losses from your cryptocurrency if the loss has been “realized,” which means you’ve sold your coins. The tax rate also differs based on whether you’ve had a coin for more than a year.

How much money has cryptocurrency lost?

$2 trillion

Overall, the crypto market has lost slightly more than $2 trillion in 2022, with prominent digital currency like bitcoin falling significantly below its 2021 highs.

Further Reading

You shouldn’t really take cryptocurrency advice from me because, as I’ve mentioned several times, I don’t understand how the hell it works or why it has value. It makes no sense to me. You should make your own decisions regarding crypto based on the advice of people smarter than I am.

One of those smart people is Nicholas Weaver, a senior staff researcher at the International Computer Science Institute and a a lecturer at the UC Berkeley computer science department. Here’s a long and interesting interview with Weaver from Current Affairs in which he says that all cryptocurrency should die in a fire. One quote:

So the stock market and the bond market are a positive-sum game. There are more winners than losers. Cryptocurrency starts with zero-sum. So it starts with a world where there can be no more winning than losing. We have systems like this. It’s called the horse track. It’s called the casino. Cryptocurrency investing is really provably gambling in an economic sense. And then there’s designs where those power bills have to get paid somewhere. So instead of zero-sum, it becomes deeply negative-sum.

Effectively, then, the economic analogies are gambling and a Ponzi scheme. Because the profits that are given to the early investors are literally taken from the later investors. This is why I call the space overall, a “self-assembled” Ponzi scheme. There’s been no intent to make a Ponzi scheme. But due to its nature, that is the only thing it can be.

And here is a recent episode of This American Life in which host Ira Glass explores the world of cryptocurrency and NFTs (non-fungible tokens).

Finally, from The New York Times (and therefor possibly behind a paywall for you) is the latecomer’s guide to crypto, which does its best to be an even-handed overview of the world of cryptocurrency.

If you know of articles or podcasts or YouTube videos that do a good job of explaining cryptocurrency, please leave them in the comments so that I can add them to this list.

Let me know if there are more pieces I should add here…

Source link