The Indian government has introduced a new tax regime for the assessment year 2023-2024. Under this new regime, taxpayers can choose to pay tax at lower rates, but they will have to forgo certain deductions and exemptions.

To opt for the new tax regime, taxpayers must file Form 10-IE. This form is available on the Income Tax Department (ITD) website.

Who needs to file Form 10-IE?

The following taxpayers need to file Form 10-IE:

- Individuals with business or professional income

- Hindu Undivided Families (HUFs) with business or professional income

- Partnerships with business or professional income

- Companies with business or professional income

When to file Form 10-IE?

Form 10-IE must be filed on or before July 31, 2023. After filing Form 10-IE, you can file your income tax return (ITR) for the assessment year 2023-2024.

How to file Form 10-IE

Form 10-IE can be filed online on the ITD website. To file the form, you will need to have a valid PAN card and a digital signature certificate (DSC).

The following steps will guide you through the process of filing Form 10-IE:

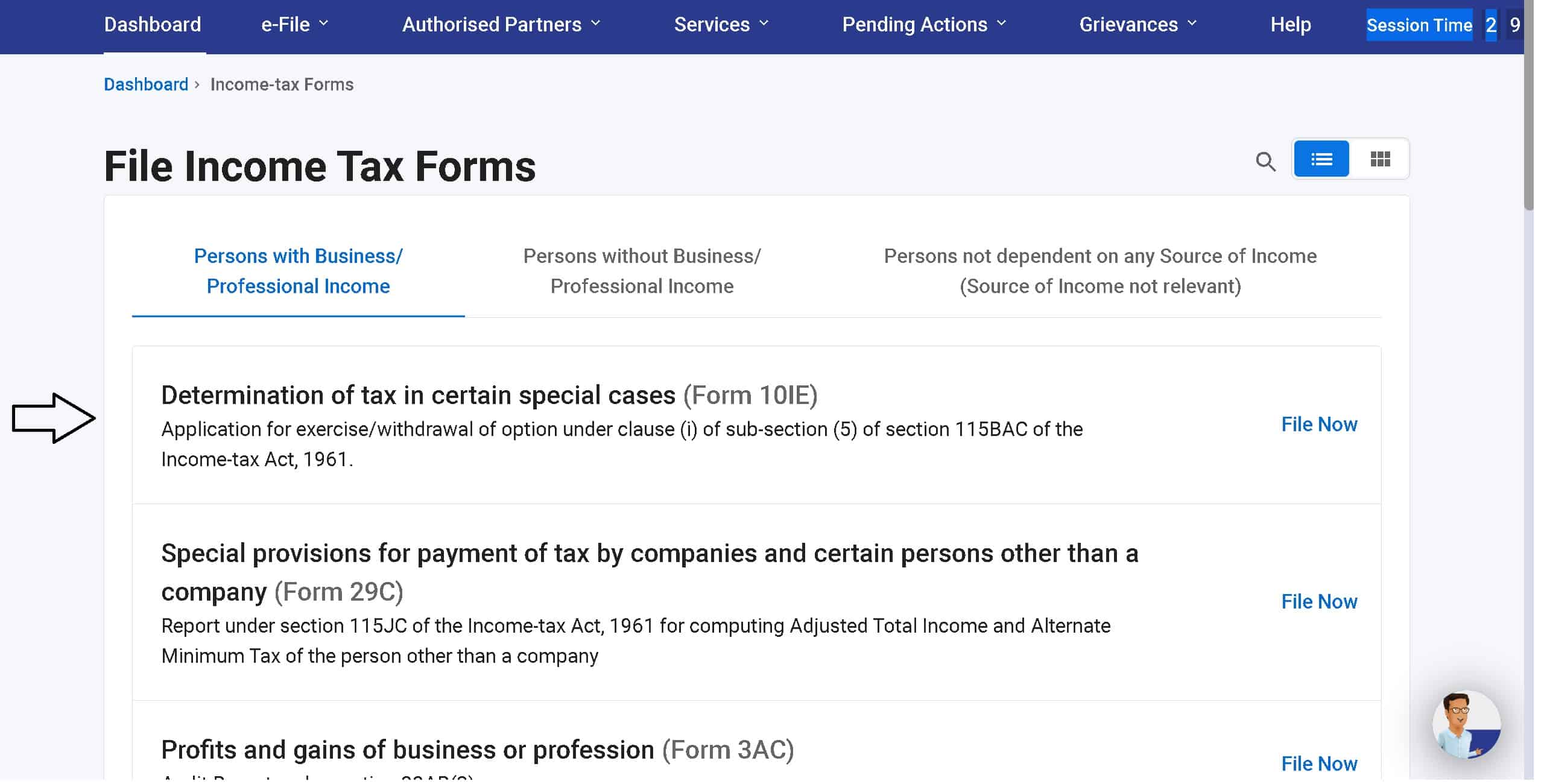

1. To file form 10-IE, login to the income tax portal and go to e-File > Income Tax Forms > File Income Tax Forms

You can either search for the form or scroll to the second page to see its listing.

Once you select the form and choose the relevant AY, there are four sections to complete.

1. Assessing Officer (Details of Assessing Officer) – pre-filled.

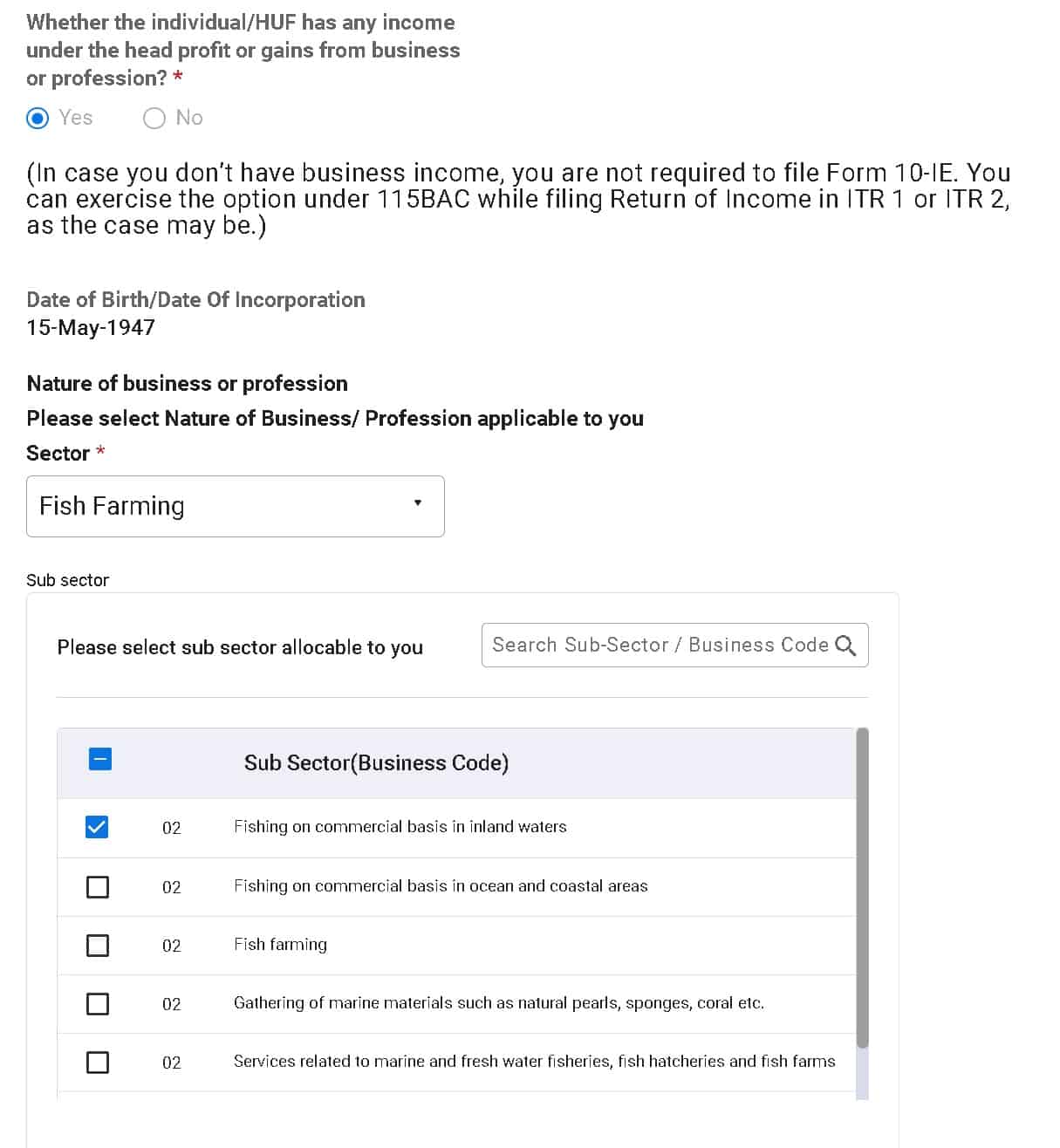

2. Basic Information (provide Name, PAN, and address details) – you must enter the nature of the business or profession and the sub-sector. Those filing ITR4 or ITR3 regularly would be well aware of these.

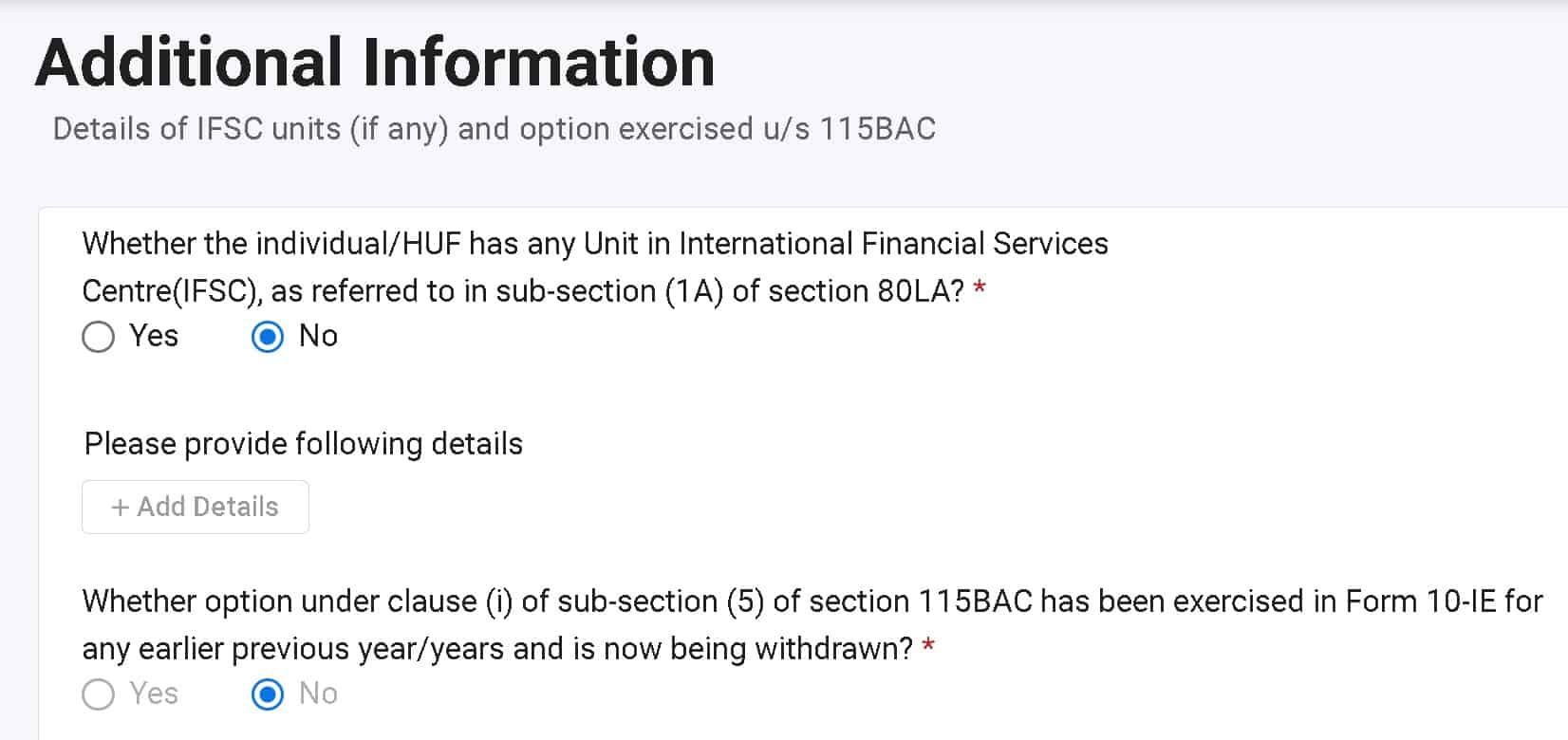

3. Additional Information (Details of IFSC units (if any) and the option exercised u/s 115BAC)

- Choose Y/N: individual/HUF has any Unit in International Financial Services Centre(IFSC), as referred to in sub-section (1A) of section 80LA

- Choose Y/N: Whether option under clause (i) of sub-section (5) of section 115BAC has been exercised in Form 10-IE for any earlier previous year/years and is now being withdrawn? This is to find out if a switch new regime was done earlier and if the current application is to switch back. Choose N if opting for the new tax regime for the first time.

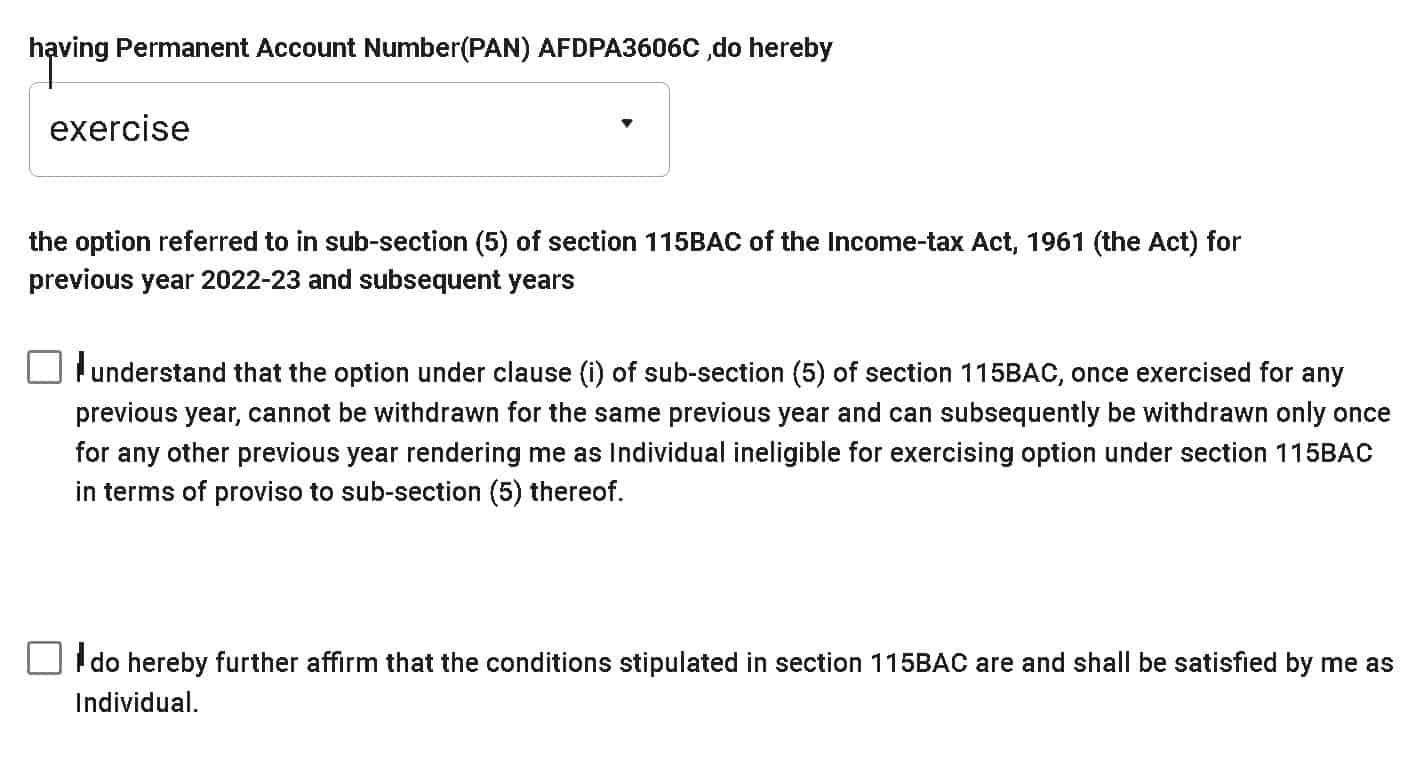

4. Declaration for the switch and Verification in the same manner as ITR via OTP or other ways.

Once you have submitted the form, you will receive a 15-digit acknowledgment number. This number is important, as you will need to mention it when you file your ITR for AY 2023-2024.

Benefits of filing Form 10-IE

There are several benefits to filing Form 10-IE. These benefits include:

- Lower tax rates: Under the new tax regime, taxpayers can choose to pay tax at lower rates.

- Simpler tax filing process: The new tax regime is simpler than the old regime, which makes it easier for taxpayers to file their ITRs.

- Increased flexibility: The new tax regime gives taxpayers more flexibility in choosing the deductions and exemptions that they want to claim.

If you are an individual, HUF, partnership, or company, and you are considering opting for the new tax regime for AY 2023-2024, you will need to file Form 10-IE. Filing Form 10-IE is a simple process that can be done online. By filing Form 10-IE, you can benefit from the lower tax rates offered under the new regime and make the tax filing process easier for yourself.

FAQs

When should Form 10-IE be filed?

Form 10-IE must be filed before filing your Income Tax Return (ITR) for the assessment year 2023-2024. The last date for filing ITR for AY 2023-2024 is 31st July, 2024.

Where can Form 10-IE be filed?

Form 10-IE can be filed online through the Income Tax Department’s e-filing website. You can also file Form 10-IE offline by submitting it to any of the Income Tax Department’s authorized service centres.

What are the benefits of filing Form 10-IE?

By filing Form 10-IE, you can avail the following benefits:

1. You can opt for the new tax regime.

2. You can claim deductions and exemptions that are available under the new tax regime.

3. You can avail the benefit of lower tax rates under the new tax regime.

What are the penalties for not filing Form 10-IE?

If you do not file Form 10-IE before filing your ITR, you may be liable for the following penalties:

Late filing penalty: You may be liable to pay a late filing penalty of ₹5,000.

Interest: You may also be liable to pay interest on the tax that is due from you.

Prosecution: In some cases, you may also be liable to be prosecuted for non-filing of Form 10-IE.

Additional Resources

CBIC to assign risk rating to GST applications, taxmen to verify documents

Aadhaar-PAN linking deadline? Here’s what I-T dept says

Last date to update Aadhaar for free extended: Check deadline and other key details